What are REITs? REITs, short for Real Estate Investment Trusts, are entities that own, manage, or finance income-generating real estate properties across various sectors. They offer individual investors a way to benefit from commercial real estate income without needing to directly purchase or oversee properties themselves. Here are the key aspects of REITs: Income Generation: REITs derive their...

Knowledge Base

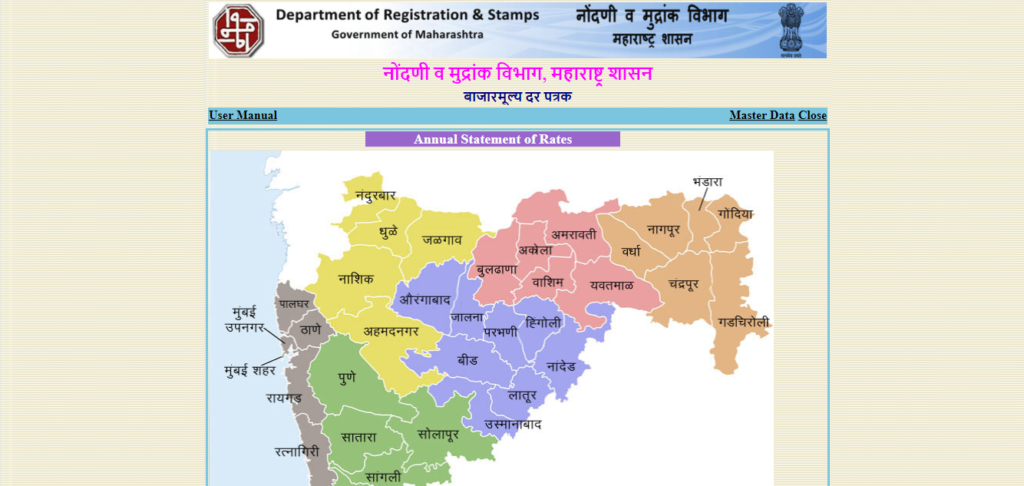

What is Ready Reckoner rates?The ready reckoner rates refer to the prices of residential, commercial, or land properties within a specific area, as determined and overseen by the Maharashtra state government. These rates undergo periodic revisions annually based on the government's assessment of market conditions. Consequently, homeowners or buyers are obligated to pay stamp duty or registration fees,...

What is Rent Agreement? A rent/lease agreement is the legally binding document that establishes a contractual arrangement between the tenant and the property owner. A rent agreement, also known as a lease agreement, is a legal document between a landlord and a tenant that specifies the terms and conditions for renting a property. It includes details such as the parties involved, property...

What is a bank auctioned property? Properties are typically auctioned by banks in accordance with the provisions and procedures outlined in the SARFAESI Act and its associated rules. This occurs when a borrower, who has pledged their properties as collateral to the bank, is unable to repay the loan amount. Why bank auction property? Typically, a bank commences the auction process when a...

From the initial down payment to closing expenses and ongoing property maintenance, we have compiled a comprehensive list of all the associated costs when purchasing a home. The question of "Can I afford a home?" might appear daunting, but essentially, you need to consider two main types of expenses: upfront and ongoing costs. Here's a detailed breakdown of the various expenses involved, helping you...

FAQs about Purchase of NA Plots in MaharashtraBuying A NA PlotWhat is an NA Plot?What are the non-agricultural uses of land?What are the advantages of an NA Plot?Great Investment Option:Construct Whenever You Wish:Ideal for Commercial Purposes:No Maintenance Costs:Things To Consider Before Buying A NA Plot:1. Location:2. Documents:3. Site...

Table of Content Return on Investment (ROI) on Agriculture Land InvestmentAdvantages of investing in agricultural landDisadvantages of buying agricultural landImportant points to check before buying Agricultural Land in Maharashtra7/12 Extract6/12 Extracts3. 8-A ExtractLand Revenue Tax ReceiptsVillage Map & Block Plan (Gaon Nakasha)Access RoadsSoil TestingReservations or AcquisitionsAgricultural...

Check your home loan eligibility Prior to seeking a home loan, verify your eligibility for it. Financial institutions establish criteria to evaluate and ascertain the risk profile of potential borrowers. The eligibility for a home loan depends on factors such as income stability, credit score, age, existing financial commitments, property value, loan amount, tenure, and down payment capacity....

What does House down-payment mean? When securing a home loan, lenders typically approve only 70%-80% of the property value as the loan amount. You must arrange the remaining 20%-30%, known as the down-payment, from your own funds. This additional amount is crucial for completing the property purchase. Beyond the mandatory down payment stipulated by the lender, you also have the option to contribute...

What is HUDCO? HUDCO, officially known as the Housing and Urban Development Corporation Limited, is a government-owned organization in India. Established in 1970 under the Ministry of Housing and Urban Affairs, HUDCO's primary mission is to provide long-term financial support for the construction of housing and urban infrastructure projects across the country. Here are some key aspects of...